Property depreciation formula

Non-ACRS Rules Introduces Basic Concepts of Depreciation. Cost of property Land value Basis.

Depreciation Rate Formula Examples How To Calculate

The recovery period varies as per the method of computing depreciation.

. For example rental buildings are classified under Class 1 and must be depreciated at a 4 rate. Annual Depreciation Purchase Price - Land Value Useful Life Span in years Annual Depreciation. Consider a piece of equipment that costs 25000 with.

Determine the cost of the asset. Each asset class comes with its own depreciation rate and calculation method. To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Basis 39 years Annual allowable depreciation expense. 1250000 cost of property. Depreciation Percentage - The depreciation percentage in year 1.

To calculate depreciation in real estate you need to know the cost basis which is the value of the property itself minus the land plus qualifying closing costs. Determine the useful life of the. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

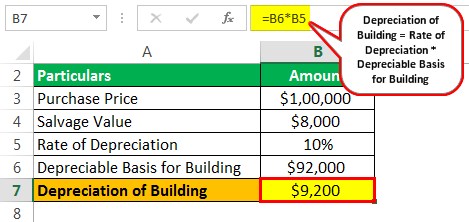

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. In such cases depreciation is arrived at through the following formula. According to the IRS the depreciation rate is 3636 each year.

Calculate Rental Property Depreciation Expense. Number of years after construction Total useful age of the building 2060 13 This is the remaining. The double-declining balance method depreciation formula is below.

Depreciation Formula for the Straight Line Method. Depreciation Expense Cost Salvage value Useful life. Year 1 Depreciation Amount Beginning Asset Book Value x 2 x 1 Recovery Period Year 2 Depreciation Amount.

The formula for depreciating commercial real estate looks like this. Alternatively the taxpayer can file a Form 3115 Application for Change in Accounting Method to request an automatic accounting method change under Rev. Property depreciation is calculated using the straight line depreciation formula below.

This is divided by. It is 275 for residential rental property under the. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Depreciation Schedule Formula And Calculator Excel Template

Free Macrs Depreciation Calculator For Excel

How To Use Rental Property Depreciation To Your Advantage

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation Schedule Template For Straight Line And Declining Balance

Rental Property Depreciation Rules Schedule Recapture

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Formula Calculate Depreciation Expense

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Of Building Definition Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Straight Line Depreciation Calculator And Definition Retipster