42+ what percent of income should mortgage be

Ad First Time Home Buyer. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

What Percentage Of Your Income To Spend On A Mortgage

Get Instantly Matched with Your Ideal Mortgage Lender.

. Lock Your Mortgage Rate Today. Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your. Bank Has The Tools For Your Mortgage Questions.

For example say you have a monthly gross income of 5000. And Canada to determine each households risk for conventional loans. It Pays To Compare Offers.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. And you should make.

Ad 10 Best Mortgages Of 2022 Top Lenders Comparison. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Were Americas Largest Mortgage Lender.

Compare Now Skip The Bank Save. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. Ad See Why CMG Mortgage Is So Highly Rated By Our Customers.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Lock Your Mortgage Rate Today.

Web The 2836 Rule is a commonly accepted guideline used in the US. On a 400000 property a 20. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Find A Loan Officer Near You. Apply Now With Quicken Loans. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Apply Now With Quicken Loans. Easily Compare Mortgage Rates and Find a Great Lender.

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information. Web Rule Of 28.

Web But with most mortgages lenders will want you to have a DTI of 43 or less. Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web While 43 is the highest DTI that borrowers can typically have and still qualify for a conventional mortgage most lenders prefer borrowers with a back-end ratio. You already pay 1000. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Choose Smart Get a Mortgage Today. Web But there are two other models that can be used. It states that a household should spend no more than 28 of its gross monthly income on the front-end debt and no more than 36 of its gross monthly income on the back-end debt.

Learn About Our Loan Options Including Conventional FHA VA And Other Mortgages. So taking into account homeowners insurance and property taxes. Web A 15-year term.

Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Were Americas Largest Mortgage Lender. Find The Right Mortgage For You By Shopping Multiple Lenders.

Realize Your Dream of Home Ownership this Year. Ad We Are a Locally-Owned Mortgage Broker. Calculate Your Mortgage Or Refinance Rates With Our Tools And Calculators.

Ad Compare Mortgage Options Calculate Payments. Ad Compare Mortgage Options Calculate Payments. John in the above example makes.

Here S How To Figure Out How Much Home You Can Afford

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

How Much Of My Income Should Go Towards A Mortgage Payment

42 Acres Buffalo Dr Anderson Ca 96007 Realtor Com

What Percentage Of Income Should Go To Mortgage

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Income Should Go To Mortgage

What Percentage Of Income Should Go To A Mortgage Bankrate

42 Sample Budget Checklists In Pdf Ms Word

Housing Affordability Presentation

42 Acres Buffalo Dr Anderson Ca 96007 Realtor Com

What Percentage Of Income Should Go To A Mortgage Thrive

What Percentage Of Income Should Go To Mortgage

Solved Kim And Kanye Go Kayaking Kim Heads Due East For 5 0 Km At The Course Hero

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

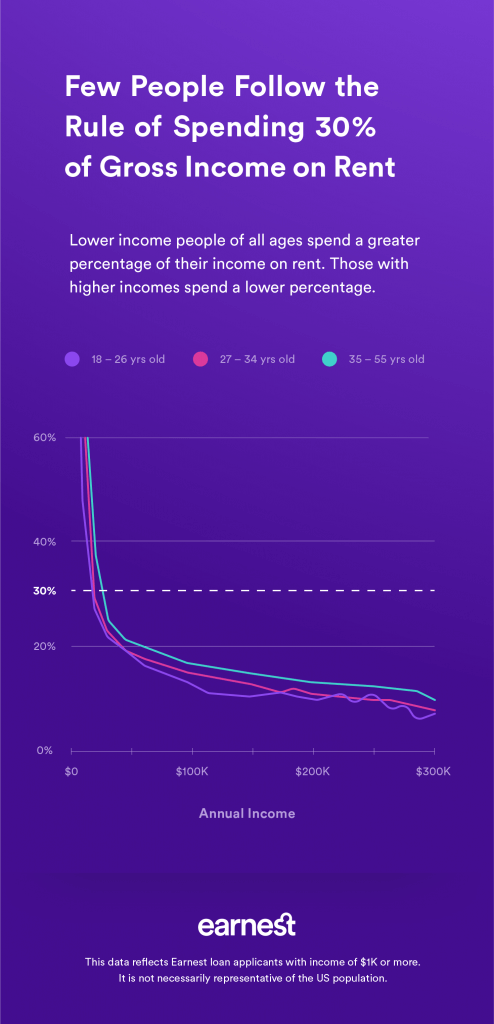

How Much Should I Spend On Rent Ignore The 30 Percent Rule Earnest